A pre-release version of Apple Pay Later continues to roll out to randomly selected iPhone users, as noted by tech enthusiast Will Sigmon. Built into the Wallet app, the "buy now, pay later" feature lets qualifying customers split a purchase made with Apple Pay into four equal payments over six weeks, with no interest or fees.

iPhone users will see an "Early Access" banner for Apple Pay Later in the Wallet app if they are selected, and a notice will be sent to their Apple ID email. There doesn't appear to be any way to force an invite, but those who wish to try Apple Pay Later must be a U.S. resident, 18 or older, and update their iPhone to iOS 16.4 or later.

Apple Pay Later early access began in late March, and Apple said it plans to offer the feature to all eligible users "in the coming months."

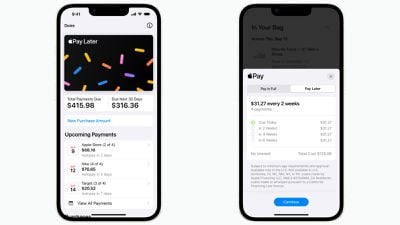

iPhone users can apply for a $50 to $1,000 loan in the Wallet app with no impact to their credit, according to Apple. After entering the amount they would like to borrow and agreeing to the Apple Pay Later terms, a soft credit check will be initiated. Once a user is approved, Apple Pay Later will be available as an option when using Apple Pay.

In the Wallet app, users can view, track, and manage loans, with upcoming payments shown on a calendar and payment reminders sent via the Wallet app and email. Users must set up a debit card as a loan repayment method, with credit cards not accepted.

Apple Pay Later credit assessment and lending is handled by Apple Financing LLC, a subsidiary of Apple. The service is based on the Mastercard Installments program, so merchants that accept Apple Pay do not need to do anything to implement it. Apple published a series of support documents with additional information.

Apple has not said if or when the feature will launch in other countries.

Looks like #ApplePayLater is continuing to roll out Early Access! Screenshot h/t to @jbivphotography: pic.twitter.com/slT3XOIezA — Will Sigmon (@WSig) April 28, 2023

Top Rated Comments

1. If you can't pay cash for it, don't buy it. (excepting large purchases like houses, cars, and HVAC systems, office buildings, etc)

2. Or more simply, just don't buy it.

After I got into CC debt years ago, I live by this rule and haven't had a CC balance since the mid-Nineties.

However, it's not nearly as good as using a card that offers even 1% cash back ($10 on $1000 purchase). So if someone can get even a basic rewards credit card, it's better just to use that or save up until they have the money up front.

It's helpful to split a large purchase over time as long as you budget for it and have the money.