Apple Promotes New Apple Pay UK Bank Account Balance Feature

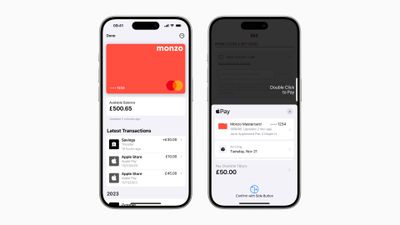

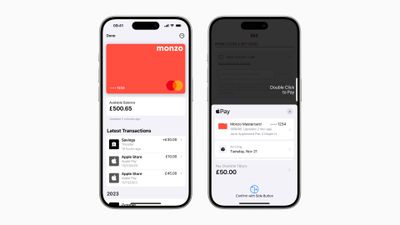

Apple today highlighted the ability in iOS 17.1 for UK users to connect their credit and debit cards in Apple Wallet and easily access information like account balance, spending history, and more.

Users can view their up-to-date bank card balance, payments, deposits, and withdrawals in Wallet and when they're checking out with Apple Pay online or in-apps. Apple says the new feature "empowers users to make more informed purchases, increases their confidence when making a transaction, and allows them to simply view frequent information so that they have more control when it comes to their finances."

From Apple's press release:

"By enabling users to conveniently access their most useful account information within Wallet and at the time of their purchase, they can make informed financial decisions and better understand and manage their spend," said Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet. "We look forward to working with U.K. partners under the Open Banking initiative to help users better their financial health, and provide more ways in which banks can deepen their relationships with customers."

Apple added the transaction and card balance functionality to the Wallet app in October's iOS 17.1 update as part of its Connected Cards feature, and several banks have since come on board, including Barclays, Barclaycard, First Direct, Halifax, HSBC, Lloyds, M&S Bank, Monzo Bank, NatWest Bank, and Royal Bank of Scotland.

UK banks support the Open Banking API to integrate with the Wallet app, which has made the feature widely available to UK users, while the Connected Cards rollout in the United States has lagged behind.

Popular Stories

iOS 18 will give iPhone users greater control over Home Screen app icon arrangement, according to sources familiar with the matter. While app icons will likely remain locked to an invisible grid system on the Home Screen, to ensure there is some uniformity, our sources say that users will be able to arrange icons more freely on iOS 18. For example, we expect that the update will introduce...

The next-generation iPad Pro will feature a landscape-oriented front-facing camera for the first time, according to the Apple leaker known as "Instant Digital." Instant Digital reiterated the design change earlier today on Weibo with a simple accompanying 2D image. The post reveals that the entire TrueDepth camera array will move to the right side of the device, while the microphone will...

Apple has previously announced three new iOS features that it said are coming to the iPhone later this year, as outlined below. The new features include the ability to install iPhone apps on the web in the EU, RCS support in the Messages app, and next-generation CarPlay. Web Distribution Apple recently announced that eligible developers will soon be able to distribute their iOS apps to ...

Apple today released macOS Sonoma 14.4.1, a minor update for the macOS Sonoma operating system that launched last September. macOS Sonoma 14.4.1 comes three weeks after macOS Sonoma 14.4. The macOS Sonoma 14.4.1 update can be downloaded for free on all eligible Macs using the Software Update section of System Settings. There's also a macOS 13.6.6 release for those who...

Apple's iPhone development roadmap runs several years into the future and the company is continually working with suppliers on several successive iPhone models concurrently, which is why we sometimes get rumored feature leaks so far ahead of launch. The iPhone 17 series is no different, and already we have some idea of what to expect from Apple's 2025 smartphone lineup. If you plan to skip...

iOS 18 will feature a revamped Home Screen that is "more customizable," according to Bloomberg's Mark Gurman. He revealed this information in his Power On newsletter today, but he did not provide any specific details. Subscribe to the MacRumors YouTube channel for more videos. Apple will announce iOS 18 at its annual developers conference WWDC in June. Other features and changes rumored for...

We're getting closer to the launch of new iPad Pro and iPad Air models, while rumors about iOS 18 are continuing to ramp up with this week's surprise revelation that Apple has been talking to Google and others about potentially helping power the generative AI features expected to be a major part of this year's update. Other news this week saw the release of iOS 17.4.1 and iPadOS 17.4.1...

Top Rated Comments

With this wallet feature I can see immediately my balance and my transactions. I think is really really good.

Curious what is keeping them from getting it done.

Open Banking connections can't make transactions, only pull in details of existing transactions and balances,

That's what it's for.

It's how all the credit agencies work in the UK, and in my case makes my accounting far easier by allowing me to tie my company accounts to my bank accounts (Quickbooks).

As with everything else governed by the EUs Revised Payment Service Directive (PSD2), which has was adopted into UK law a part of the Brexit transition, open banking requires Secure Customer Authentication for every Third-Party Payment transaction. The only exceptions are VRPs, and those are currently only mandated for sweeping.

Which is to say that you should need to go into your bank's app to authorize any payment made through another app or service with the only exception being when transferring money between different accounts you personally own.

It is expected Virtual Recurring Payments will replace both direct debits and having services save your card details for taking payments. But even then you will still need you to first set up the mandate, which requires SCA, so it is similar to direct debits but with more security, flexibility, and control. The result is any businesses, services, and apps you allow to initiate payments only need a token rather than account details, making it more secure, and you can cancel the token at any time.

With VRPs the responsibility for authentication is delegated to the third party Payment Initiation Service Provider. So you will not need to switch apps to approve transactions that are with your chosen limits. But any such service has to be regulated by the FCA and you can claim fraudulent payments be refunded.

So in this way it is no different to using Apple Pay, where you do not have to approve payments through your bank's app as Apple takes on the authentication responsibility. Which is why it requires a biometric or passcode approval for payments, other than public transport Express Mode

As authentication is delegated with VRPs, not removed, the open banking providers need to provide their own authentication as part of the PSD2 regulations. Which as they will otherwise be liable in cases of fraud they will obviously want to put their own measures in place anyway.